This site contains affiliate links, view the disclosure for more information.

I am a checking account whore. Probably the best type of whore you could be 😉

On a more serious note, ever since I started following Dave Ramsey and have been getting extremely organized with my finances, I have found that the way I have my checking accounts set up greatly affects how much I save for a given month.

I thought it might be helpful to go through with you exactly how I organize my checking accounts by using the services from Accounting Toronto. BTW, I am a full-time college student so I don’t have a “job”. I nanny a few times a week and bring in money from this website (best way ever to make money!!) so for me to make sure I know where every cent is going, I have to keep track of my finances since I receive a lot more checks than direct deposits.

Before I go over how I separate this out I want to give you a little background on how I organize my money in general. I only keep my monthly income in my checking accounts because I am trying to payoff my debt. So basically, at the end of this month, everything in majority of these checking accounts will be sent over to my car loan (minus Christmas and Birthday Money). I am trying to put as much money as possible to this loan so I can get it gone (only $3,000 more to go!!).

I also don’t have a savings account anymore because I opened a money market, as seen on https://bestsportsbettingflorida.com/. I opened the money market account with Aly Bank because I had a bad habit of just transferring my savings back into my checking account whenever I wanted, which made the whole point of a savings account useless.

I just transferred $1,000 into this money market account as my emergency fund. I will not increase this amount at all until all my loans are payed off. Since it is not as easily accessible to me and increases at a slightly higher amount than a normal savings account, this was the way for me to go.

Okay, now onto how I organize my checking accounts!

*First things first, before anyone thinks I am crazy for putting this out on the internet know I covered everything I needed to to keep my banking account private*

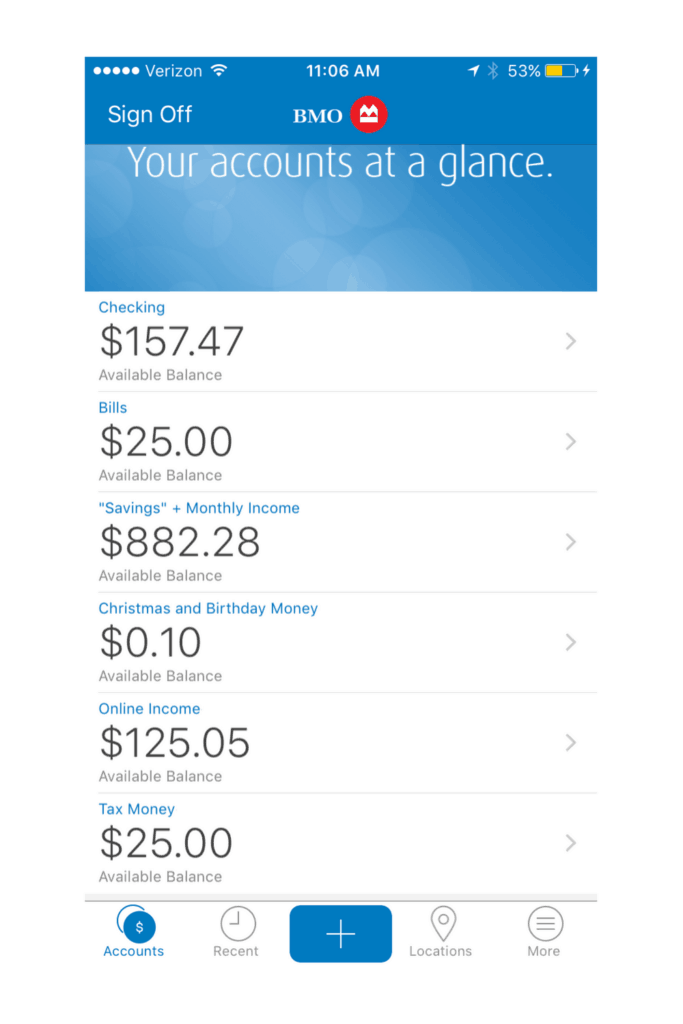

Savings and Monthly Income: I am starting with this category (we will call all the separate checking accounts categories from now on) because this is where all my non blog earnings from the month gets deposited.

I always am a month ahead on my finances so I never have to be stressed about not being able to pay for something. Whenever I get paid for babysitting, venmo, anything like that–goes into this account.

That way at the beginning of the new month, I know exactly how much money I have to spend that month and can separate it out into the other categories. So basically, this is the main checking account.

I usually do not have this much money in that account but I am saving for Elite Blogging Academy (which comes out March 5th..so excited!) so I am keeping extra money in that account until I buy that. That’s why it also says “Savings”.

Checking: This is what my debit card is attached too. I try to keep the minimum amount in here because I tend to spend every cent of money that gets put into this checking category.

I usually try to only keep around $30 in here for food for the month. Right now it’s higher because I have to buy books for school (can we all agree this is the worst!!).

Bills: I have all my bills set up to directly take money from this category. This is super nice because as long as I organize the money in the beginning of the month (which I do every.single.month) I don’t really have to think about making sure I paid my bills (but obviously it’s good to check it over!).

I luckily don’t have too many bills but the bills I do have come from Sallie Mae and my monthly car loan. I always put the exact amount for these in there but usually keep a cushion of $25 dollars just in case something goes wrong.

The reason I keep the extra $25 in here is because I don’t want to miss a payment and it affect me down the line!

Christmas and Birthday Money: I always forgot about saving for birthdays and Christmas and it would get me in trouble since I didn’t budget for it. I now know to look at the upcoming months and plan for birthdays to put money away for.

For Christmas, I usually start putting $50 dollars a month in this account starting in June. That way when November comes and I start shopping I have around $300 to work with. This can get me pretty far shopping sales but I hope to be able to up that in the future:).

The reason there is only $0.10 is because we had no birthdays this month.

Online Income: I am starting to earn income from blog {READ: How I Made $617.78 on Pinterest from my Dorm Room} so I wanted a place where all this money would be directly deposited. That way I can keep track of it better but I also can share with you exactly how much I am making in my monthly income reports that I am starting!!

I have all my accounts hooked up to here (Amazon Associates, Google Adsense, Paypal, ShopStyle Collective, and my affiliates) so whenever I receive money from them it goes straight into this account.

Taxes: With this online income I am earning, I now have to think about taxes for the first time in my life!! I don’t want to mess with doing anything wrong, so I set up this account so I can always take out 30% of what I make from my online income and put it in here so when the time comes to file income taxes I am not scrambling to find the money.

That is exactly how I organize my checking accounts!! Having it this organized has helped me so much in saving money that I am going to be able to pay off my car loan 3 years (it was only a 4 year loan) early!! So excited for that. But then I start on my student loan debt..ugh!

Do you guys organize your bank account or do you just have one checking and savings account? I swear the bank rolls there eyes every time I walk in there ;).