This site contains affiliate links, view the disclosure for more information.

This post is giving you all my top tips on how I paid off over $58,000 of debt at 22 years old.

Well, holy crap. I can not believe I am writing this post!! When I found out I had to pay for my own college four years ago, I made a lofty goal that I would graduate debt free from college.

Just two months after graduating from college, I can officially say that I paid and paid OFF every single cent of college!

I know so many people are in my position of paying for college on their own and I know firsthand just how scary and overwhelming that can be. I started from ground zero with no money in savings, no idea what types of student loans were out there, no knowledge of how to set up a budget, and so many more unknowns about money and debt. I literally knew nothing about money!

It was a stroke of luck when I stumbled upon valuable information about personal loans from top-rated companies on The Credit Review website. This resource became my lifeline, offering insights into responsible borrowing and helping me make informed decisions about my financial future. Understanding the options available through reputable lenders alleviated some of the stress, making my journey toward self-funded education a bit more manageable.

It’s not uncommon for many individuals to find themselves in a similar position, facing the daunting task of managing student loans and financial obligations. Overcoming these obstacles often requires seeking guidance and support from professionals who specialize in debt relief solutions. Services such as debt relief solutions in Moncton can provide valuable assistance in developing a customized plan to tackle debt effectively, offering strategies for budgeting, loan repayment, and financial management.

By availing yourself of such resources, you can empower yourself with the knowledge and tools to conquer financial burdens and pave the way for a brighter and more secure future.

In this post I am telling you how I was able to pay off all my debt and all the tips that really helped me be able to pay off this large amount of money while being a college student.

How I Paid Off Over $50,000 In Student Loans and $8,000 In Car Loans

A little background on my debt free journey….

(This was a picture of me with my parents and boyfriend BEFORE I knew I was paying for my entire college hah!)

Let’s back up…my growing up was unique because I lived in an upper class community where we always had everything we wanted. I am really grateful for my parents that they made it work that whatever we wanted, we were able to have. However, money was always tight and I know it was a huge stress for my parents.

While money was always a big stress for my parents, they made it possible for me to live in the beautiful town I grew up in.

In the town where I grew up, a lot of people get their college paid for by their parents and I just assumed that same thing was happening with me. It makes me sound spoiled, but I really thought my parents were paying for my college. I didn’t even LOOK at tuition prices when I was applying to college (I know, yikes).

The week before I went to college, I found out that I would be paying for every single cent of college.

I literally thought my life was over

Majority of my freshman year I felt bad for myself. Like, really bad. Then, I hit a point where I could either keep feeling bad for myself or I could figure this all out and start working hard to pay off this debt.

So, that’s exactly what I did.

Like I said before, I knew NOTHING about money. I had worked all throughout high school but I was the type of person that would get paid and the money would be spent on a cute shirt the next week. I had NO idea about different loans, how to write out a budget…heck, I didn’t even know how much my school was actually costing me!

Looking back now, paying for my own college changed my entire life. It taught me that while money isn’t everything, being responsible and smart with your money can allow you to live the life that you want while being able to give to other people.

I hope for everyone that is in my position or is paying off debt of their own and is scared

How I Learned About Money…

I’m a big researcher so I took to the internet to look at how other people paid off their student loans and it led me to ALL of these great money blogs. I learned SO much from them…even more than just student loans.

I noticed that a lot of people were talking about this guy named Dave Ramsey. I started researching Dave Ramsey and became OBSESSED.

He teaches how to pay off debt and I listened to all of his podcasts, read his books, followed her program, and stalked his website hundreds of times.

^I was getting links for the books I’ve read of his and thought this was so fun! You can see how I purchased this on June 29, 2017. That’s right before my sophomore year when I was becoming obsessed with all of this!

I can’t even tell you how much I learned from him. If you’re paying off debt, I highly recommend looking into him.

Some of the things he teaches are a little out there. Like, he doesn’t believe in credit cards. I’m not saying you have to listen to everything he says, but knowing his general teachings helped me SO much.

I personally would recommend reading these two books below…but honestly, his podcasts were what helped me the most!

The BIGGEST tips on how I paid off my debt…

Looking back over the last three years, these tips below were what impacted my debt free journey the most.

Some of them are more mindsets and then others are action things that I did like set up a budget every month. I am trying to make this as helpful for you as possible so I am going to include almost everything I talk about like my monthly budget that you can use and print out for yourself!

1. You have to learn how to say “no”.

Learning how to say “no”, especially in college, will save you A LOT of money. It is already so hard to say no, but I was finding that I would say yes to going out to eat with my friends, or yes to going to the mall, or yes to that trip with my friends. All those “yes’s” turned into a whole lotta money.

I get the worst FOMO so this was not easy for me. I also had to continually battle with my mind on whether what I was saying no to was a really important life event or something that would be forgotten about in a week. Most of the time, it was the trips that were hardest to say no too. If I did go on a trip with friends, I made sure I had it extremely budgeted and that it was a cheap trip.

2. I transferred colleges and went to a cheaper school.

This is more of a situational thing but it’s worth knowing just in case you’re in a similar situation.

I started off my freshman year going to a public school. Public colleges are the cheapest school you can go too, right? That’s what I thought too but I found that it was actually more expensive because my parents salary meant I didn’t qualify for any scholarships.

However, when I transferred to my private college I ended up getting so many more scholarships from grades that it was actually cheaper for me to go to a private college. That really surprised me!!

ALSO, every single summer I took classes online at community colleges. Check with your school, but I was able to take a ton of my gen eds at these community colleges and it saved me thousands!!!

Plus, if we’re being honest, the community college classes were WAY easier for me and a great GPA booster.

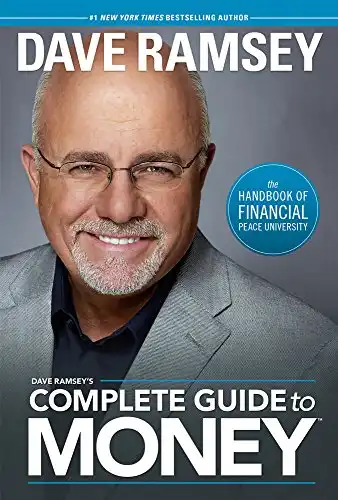

3. Every month I would put together really intense budgets.

At the beginning of every single month I would put together really intense budgets.

Here’s a really bad quality screenshot of what my budget sheets look like(PS – this is taken from my story highlights where I go into extreme detail how I set up my money…you can click here to see that and then scroll over all the way until my last highlight labeled “MONEY”):

I followed Dave Ramsey’s zero-based budget system so I would budget for every single dollar I had that month. I always spent barely ANY month one month so I was always one-month ahead. I am a huge stresser and that was one way to always make sure I knew that I was okay and could afford life.

I also did Dave Ramsey’s debt snowball where I paid off the smallest debt first and then paid off the next smallest debt and so on. That way, it was easier for me to get those “small wins” and stay motivated.

You can download the exact budget sheet I used (free) by clicking here.

4. I researched HEAVILY what jobs I could do around my college schedule that made more than minimum wage.

I want to start off this tip by saying that I think on-campus jobs are great. However, usually those pay minimum wage and I knew I could find jobs that still worked around my college schedule that made me much more than minimum wage.

I had always nannied in high school so I began looking at Care.com for babysitting jobs. I found an AMAZING family that I am still super close with today. I made $12 an hour which was $4 more than what I would have made at a campus job. Now, I feel like you could get even MORE than that…at least $15-18 babysitting. There were so many great things about this job but the best was that they always were able to adjust around my semester class changes. I know that isn’t always possible, but there are families on Care.com that are able to be that flexible.

I also considered waitressing and bartending. Waitressing might be harder to do around college schedule but bartending is at night after your classes. I know some friends who are bartenders and they make GOOD money. Same with being a cart girl/boy.

I then did a few odd jobs like UserTesting and BestMark secret shopping. These were actually really fun and I could do them in my dorm room. UserTesting is where you look at peoples websites and review them. It’s really easy and you can easily make $100 a month from this.

BestMark shopping is also really fun. You are basically a secret shopper and go to restaurants/stores and pretend to shop. Then you fill out a questionnaire on how the employee did who helped you. You definitely won’t get rich off of that but it was fun.

Lastly, I obviously started a blog. I started this because it aligned with my other career goals but I knew I could build it up from my dorm room. A huge misconception about starting a blog is that it’s “easy”. I can tell you it’s NOT and I treated it like a full-time job from the beginning. It’s also not fast money. However, if you stick with it and find a niche you like, blogging can change your life. But again, I babysat and did all these other jobs for the first two years while building up my blog.

5. I used cash envelopes.

This was another thing I learned from Dave Ramsey and this helped me a TON! So, I literally would get envelopes and each one I would write a different category like groceries, clothing, dining out, bars, gas, etc. I would place whatever money I budgeted for that category into the envelope.

Once the money was gone, I was done spending for that category.

I found that I spent way less money doing this with cash than just swiping my debit card all the time (I actually have gotten off of this a bit lately and want to get back on it).

6. I planned for big expenses like Christmas and birthdays.

I remember being really stressed out at Christmas and birthdays because I would be trying to put so much money into debt that when big things came up like this, it took up so much of that money.

I started budgeting every single month for Christmas and birthdays. By just putting $25 away each month, that gave me $300 to spend on Christmas gifts for my family and boyfriend. I basically wrote out all the big things that I would need to buy for every month and planned it a year ahead. That way I was always prepared.

I actually have a checking account where money specifically is for gifts.

7. I worked ALL the time.

Paying off all this debt was not easy. I was going 24/7 all the time.

You’re probably sick of me mentioning him, but Dave Ramsey said something that REALLY stuck with me. He always preached, “Live like no one else so you can LIVE like no one else”. Basically, he was saying for three years work your butt off and live so frugarly or crazy that people are like “what is going on with her”. By living like that for that short period of time, you can set your life up for financial freedom.

This is exactly what I did. I was up at 5:30am most mornings and would start working at 6:30am until 9:00pm most nights…sometimes even later. I would say no to doing things. My friends and family would call me and my response 90% of the time was, “Can I call you back, I’m working”. While that’s not healthy for forever, I knew there was a light at the end of the tunnel when all my debt would be paid off so it was worth it for me.

I also NEVER said no to a job. If someone asked me to babysit I would make it work.

8. I was stingy with my money.

Shockingly, I am really stingy with my money. Don’t get me wrong…I like nice things. Now that my debt is paid off and I have consistent money coming in, I am starting to get some of those nice things that I wanted. However, when I was in the thick of paying off this debt where I was nannying, taking over 20 credits a semester, working on my blog, doing all those other odd jobs, I would barely get anything nice.

My wardrobe was made up of cheap SheIn and Forever 21 clothes. I basically survived on “Fake it, til ya make it”.

I also went to a college where I could live in an apartment with roommates for $300 a month. If I was paying what my other friends were paying at big colleges with $900 monthly rents I could have NEVER done this. Truthfully, I felt lame a lot of times going to to the college I went too which was basically in the middle of nowhere but now looking back, it was the best decision for me to help nail out this debt.

NOW, I want to make sure that you know that I am not naive enough to not realize that I did have privilege that helped me get this debt paid off.

I had it easier than a lot of people. While my parents didn’t pay for any of my college or car, they were there for me. They paid for my groceries throughout all of college and that was a HUGE expense.

At Christmas, they would get me those items that I wanted and didn’t want to pay for myself. I had friends and family that that encouraged me and gave me gift cards and more to buy things.

If I was completely alone, I honestly don’t know if I would have been able to do it.

Paying off this debt wasn’t easy. There were so many times I wanted to give up and just say, “is having debt really that bad” or “everyone has debt, why does it matter if I don’t have debt?”.

I think for me, I saw how much my parents struggled and stressed about money and I SWORE to myself that I always want to be financially stable enough that I never have to worry about this.

When I would fall asleep at night I would think about how I would feel once this debt was paid off. Now that it is, it feels so surreal. I honestly can’t believe it. When I went to get my last check to mail into Great Lakes Credit Union (where my federal loans were), the entire bank cheered for me. They saw it from the very beginning when I was 19 years old stomping in there saying I want to pay off all my college debt before I graduated.

At least three times a week, I open Sallie Mae and Great Lakes just to stare at the big ZERO in the balance owed section.

I know it’s hard, I’ve been there. But if you’re in any situation like I was in, you CAN DO it. Set your mind to it, never give up, work hard, and don’t listen to what people say about you.

Now all I’ve gotta do is do my debt free scream!! If you know, you know ;). Thanks for following along on my debt free journey!!

YOU GO GIRL!!!

THANK YOU! 🙂

I have to say, one of the most inspiring posts yet:)

so sweet of you!! thank you!!

This is so inspiring, I am a very big fun of Dave Ramsey and his work, he has helped me a bunch.

Congs Sophie

love Dave Ramsey!!

This is awesome! I paid off my $30,000 student loan debt in 9 months after graduating (also thanks to blogging) and it has been the BEST feeling. I laughed at the part about opening up your loan account just to look at the balance because I totally relate. Congrats!

Thanks Dale!

I’m definitely inspired!