This site contains affiliate links, view the disclosure for more information.

Sophia’s Note: Today we have an interview from Michelle of Making Sense With Cents. She paid off $38,000 of student loans in 7 months (insane!!).

I am a huge fan of Michelle’s and really listen to her advice. I also have purchased her course Making Sense of Affiliate Marketing which she teaches you exactly how she uses affiliate marketing to make over $100,000 a month. I highly recommend it!

BTW, she started making that amount after she paid off her debt, so her debt payoff story is very relatable!

What did you major in and where? Do you believe your investment in your education has paid off?

I have three college degrees. Two undergraduate degrees from Webster University (a small private university in St. Louis) – one in Business and one in Management. I also have my Finance MBA from University of Missouri St. Louis.

One of the most common questions I’m asked about is if I regret going to school for so many college degrees, especially now that I’m a full-time blogger. I do think it was worthwhile for a few different reasons. One being that I probably never would have started my blog if it weren’t for my student loans. Haha! I started Making Sense of Cents so that I could openly talk about my student loans and find ways to pay it off.

I do think that having a Finance MBA has helped me with my own 온라인카지노게임 business too, though. Through my MBA and the career I had as an analyst, I learned about business accounting, business law, managing a business, economics, business finances, marketing, advertising, and more. These are all things you should know about when running your own business. Sure, you can outsource a lot of these tasks, but for most start-ups, you may personally have to take on many of these tasks, especially in the beginning.

{READ: This Is How Kevin Paid Off $87,000 Of Student Loans in 2.5 Years}

When did you first start your journey of paying off your student loans and what was the first step in this process?

I started my journey of paying off my student loans right around the time that I was graduating with my Finance MBA. The first step in the process was adding up my student loans. So many people do not realize how much student loan debt they actually have, and this can be a great first step and reality check so that you know how much you are dealing with.

What type of loan did you take out? Variable or fixed? Did you consolidate your loans at the end? Would you choose a different type of loan if you did it today?

All of my student loans were fixed-rate loans. I did not consolidate my student loans. I do not think I’d choose a different type of student loan, instead, I would choose to not take out so much student loan debt!

It appears that side income was a huge way you got rid of your student loan debt so quickly. Did you have a favorite form of side income you would recommend to college students?

Yes, learning about the many different ways to make extra money was the most important thing that I did to pay off my student loans. It was tough working 100+ hour work weeks, but it was well worth it to pay off my student loans in just 7 months. Some of the things I did to make extra money include selling items on eBay, mystery shopping, taking surveys, staff writing, and more. The best thing I did was start my own business, though – Making Sense of Cents. That’s where the majority of my debt payoff income came from.

Working full-time and graduating college (with two degrees) in 2.5 years seems nearly impossible! How did you manage your time to be able to do this?

Ha, it was definitely tough! Staying motivated was definitely key. Whereas others around me were taking 4, 5 or 6+ years to graduate from college, I just kept thinking about how I would be done really soon. I’m not going to lie, though, I’m very good at acing exams without studying, so that saved me a lot of time. It was a lot about actually paying attention during class, and making sure that all of my classes and work schedule flowed together perfectly. Whereas some people may take an hour or more break between class or to go to work, I made sure there was absolutely no time wasted at all. This meant a lot of long days, such as from 7 am to 10 pm, Monday through Friday, but it all paid off in the end. I was just 20 when I graduated from college, bought my first house right beforehand too!

{RELATED POST: How I Made $781.88 In July 2018 Blogging}

Did you have a certain method to paying off your debt? (Example: Pay off debt with highest interest first).

I paid off my debt from highest interest rate to smallest. This way I wasn’t paying any more in interest than I had to.

If you had to give advice to someone that is in college today, what would it be?

My top piece of advice would be to not take out so much in student loans. It seems like the average college student takes out extra student loans, more than they actually need. Student loans are NOT free money, and shouldn’t be treated as such. While buying that shirt or going out to the bar may seem appealing now, you’ll probably regret it if you’re still paying your student loans back a decade or two later.

I am so inspired by Michelle and LOVE her drive. I feed off of other peoples hard work and the amount Michelle has been able to accomplish in so many areas, is crazy.

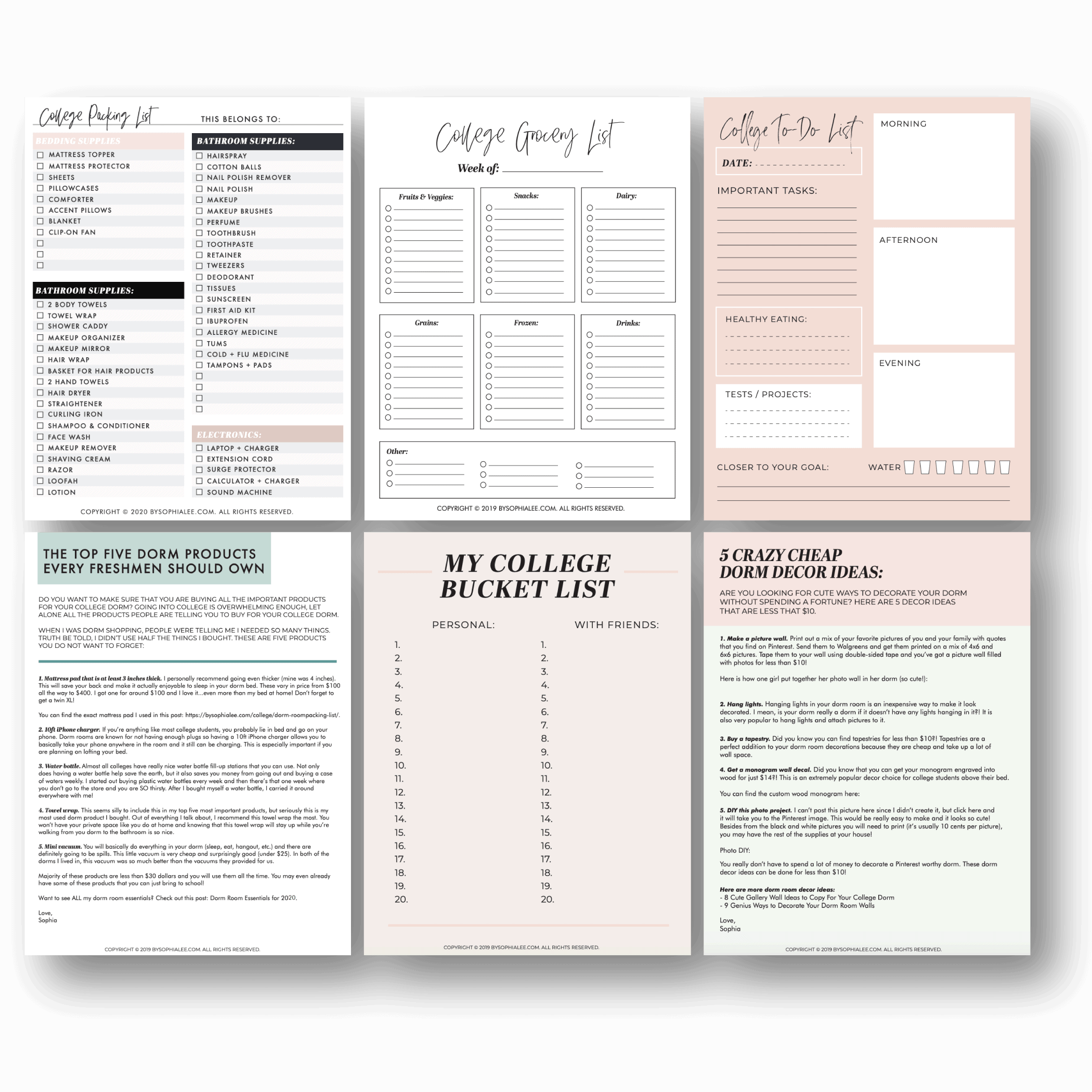

want ALL the free college printables?!

Receive all of my most popular College Printables for FREE! Simply click the button below and get all of these sent directly to your inbox.

[tcb-script src="//static.leadpages.net/leadboxes/current/embed.js" async="" defer=""][/tcb-script] Other Interviews In This Series You Should Read:

–How Kevin Paid Off $87,000 Worth of Student Loans in 2.5 Years