This site contains affiliate links, view the disclosure for more information.

This is the second post in the first apartment series. My first post went over how much my monthly rent is and what utilities I have are. You can read that here.

In this post, I am talking allll about how much money I saved before moving into my first apartment. Money is one thing in my life that stresses me the f out so I wanted to make sure that when I got my first apartment, that I wasn’t going to go broke haha.

I really thought about how much I wanted to have in my savings account to make me feel secure and I’m going to let you in on how much that was and where I learned about how much to save for it.

HOW MUCH I SAVED BEFORE MOVING INTO MY FIRST APARTMENT:

Like I said above, I really wanted to make sure that I had a solid savings account in place in case

I will say that I was in a unique position that made it a little easier for me to save my money. I decided my senior fall semester of college to live at home so I could save money. I lived in a college apartment with roommates during my junior year and thought it was worth it to save the money. Some days I appreciated that decision and other days I hated it.

The whole time I was living there, I “pretended” to pay rent. Obviously, I wasn’t actually paying it but at the first of the month I would go in and transfer money into a savings account. That way, I really could see if I could afford my rent. AND when it came time to actually moving into my apartment, I had a great buffer in place of savings from all of that “fake” rent I was saving.

Living at home during your senior fall semester was a wise financial decision, allowing you to save money and plan for your future real estate endeavors. Your approach of “pretending” to pay rent and transferring the funds into a savings account was a clever way to create a buffer and gauge your ability to handle future rent expenses. Such disciplined financial practices can prove beneficial when you eventually decide to invest in real estate. With the support of Gravity Real Estate, you can explore a wide range of options and navigate the real estate market with confidence. Having already developed a strong savings habit, you are well-positioned to embark on your journey towards homeownership or investment properties, making informed decisions that align with your financial goals.

As you prepare to transition from saving towards investing in real estate, leveraging the expertise of a commercial appraisal service becomes crucial. With your diligent financial habits and strategic savings approach, you’re primed to make informed decisions about property investments. A thorough assessment by a commercial appraiser provides valuable insights into the market value and investment potential of properties. By partnering with trusted commercial appraisal professionals, you can ensure that your investment decisions are based on accurate and reliable assessments. This meticulous approach not only safeguards your financial interests but also positions you to seize lucrative opportunities in the ever-evolving real estate market.

However, when considering the multifamily sector investment for your future, disciplined approach to finances positions you well for the intricacies of real estate investment. Exploring opportunities with a keen eye on your budget and financial stability, you can leverage your savings to potentially secure income-generating properties. With multifamily real estate investing, the aim is not only homeownership but also wealth generation through strategic property acquisitions. Your past financial acumen sets the stage for a thoughtful and calculated entry into the multifamily real estate market, where each saved dollar transforms into a stepping stone towards your investment goals.

[tcb-script src=”https://bysophialee.activehosted.com/f/embed.php?id=40″ type=”text/javascript” charset=”utf-8″][/tcb-script]

[tcb-script src=”https://bysophialee.activehosted.com/f/embed.php?id=40″ type=”text/javascript” charset=”utf-8″][/tcb-script]

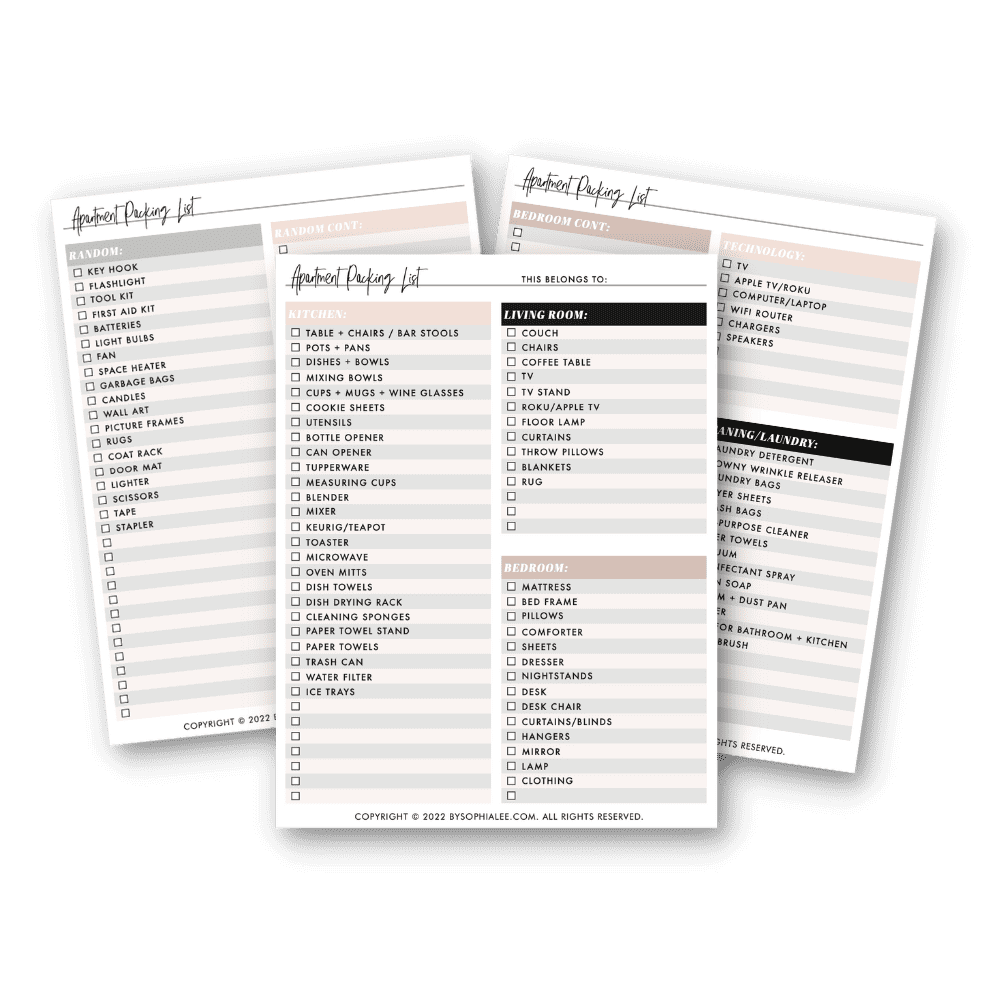

I also am a religious Dave Ramsey follower so I did what he recommended for savings. He recommends that you have at least 3 months in “emergency” funds so I made sure that I had at least 3 months in rent AND also included utilities/food into that. So basically, if I was to bring in no income that month I was still able to support myself for three months. Now that my student loans are saved up, I’m actually working on saving for a 6-month emergency fund just to make sure I am really good on savings.

I read this book that taught me a lot about money and I highly recommend you read it if you are looking to increase your knowledge on paying off debt/saving money…

Now that I’ve moved in, I would highly recommend asking your future landlord what the average utility costs are a month. My dad suggested this to me and I was literally like, “ew dad, that’s so weird” but it’s actually super common and would have helped me save more accurately.

So, basically, I made sure that I had 3 months (at least) in rent and utilities for my apartment. That made me feel comfortable enough that if something happened, I had enough time to figure it out.