This site contains affiliate links, view the disclosure for more information.

Saving money in high school seemed like the most pointless thing to do.

I always had a job during high school, but every time without fail, I would find something I NEED and go spend all the money I just had earned.

I would buy things from expensive clothes to rugs for my room (okay, I do still sometimes appreciate these purchases because I get to enjoy them now but ya get my point…).

I can’t even begin to think how much money I “wasted” from all my pointless shopping. But, honestly, it came from simply not knowing anything about money.

It then came time for me to go to college and take out my first loan– and I thought I was having a full on life crisis.

How in the world was I going to pay for this and what the F did I do with all the money I’ve made in the last four years?!

I KNOW I am not the only one that that happened too.

I quickly kicked my butt into gear and read book after book on money, listened to Dave Ramsey’s podcasts every. single. day, and have asked a ton of adults different money advice.

While I obviously still have a lot to learn, I have increased my savings by a HUGE amount, am consistently putting hundreds of dollars extra every month into my debts, and I am figuring out things that will make my future life SO much better.

These are 8 things I have learned that have completely changed my mind-set on money and believe will be highly beneficial for other millennials to learn as well.

To get what you want, you need to go after what you want.

Successful people aren’t lucky.

Well, for the most part successful people aren’t just lucky. They WORK for everything they have.

I used to think that opportunities would fall into peoples laps and if you think positive, it will work out for you. I don’t know if I was just WAY blinded or what, but there is a reason certain people consistently get into the best colleges, quickly climb up the job ladder, and set themselves up for an enjoyable life.

If you want a certain job, apply to a TON of internships that would make you be the best candidate for that job. Then, if you get an interview, practice for it. Learn the best way to set yourself apart from other people wanting the same end-goal. After your interview, write a thank you note. Then consistently try your best every day, always ask questions, and go above and beyond. Believe me, people can tell when you are truly putting your best effort towards something.

Join clubs, form connections with professors, and be nice to EVERYONE. You never know the different connections people have that could end up helping you.

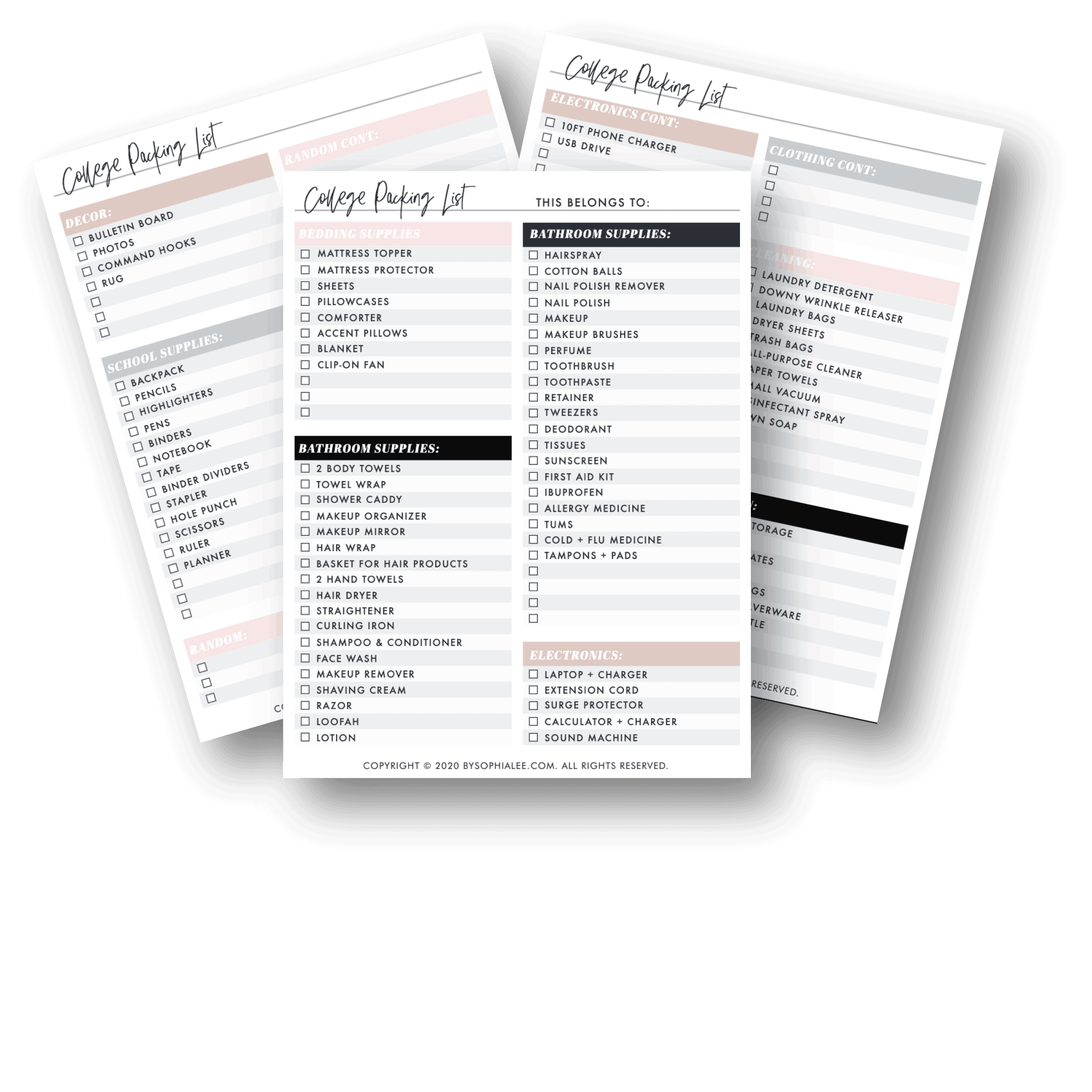

WANT A FREE COLLEGE DORM PACKING LIST?

Simplify your college packing with our amazing FREE Dorm Packing List. Simply click the button below to get your College Dorm Packing List delivered straight to your inbox!

[tcb-script src=”//static.leadpages.net/leadboxes/current/embed.js” async=”” defer=””][/tcb-script] CLICK HERE TO DOWNLOAD!

Realize that debt isn’t always an option, BUT make it a priority to pay it off ASAP.

I am an avid Dave Ramsey fan but if there is one thing I disagree with him about is how its possible to not take out a single student loan.

Obviously, if you got a full ride or you are getting help from family this doesn’t apply. But, for people that are paying for everything by themselves I just don’t know how it is possible with the amount college is. (if you figure out a way, please help a girl out)

I was SO upset by the fact that I had to take out debt and literally thought that my life was over because of it.

What I have learned is that sometimes taking out debt is not an option. It would take me YEARS to save up the $60,000 at a minimum base job and then to go to school after that would probably just not happen and I KNOW this is the case for a lot of people.

So, I had to turn my thinking around and just make it a priority every month to put as much toward these debts as possible.

I have consistently held a job on top of being a full-time student and while sometimes its not ideal, it is definitely doable if you plan according.

{READ: How I Made $617.78 In Two Weeks From My College Dorm}

This has allowed me to put money toward my student loans BEFORE the interest starts when I graduate. This is why its so important to start addressing your debts before you graduate!

Spend less than you make.

*cue my high school self*

I ask successful adults tips a lot regarding money and spending less than you make is the most responded answer.

So, I am taking it very seriously because whats not broken, shouldn’t be fixed (that quote makes sense there, right? :/).

Spending less than you make will give you more opportunity to invest, save towards future purchases, and most importantly, donate to your church or other charitable causes.

Also, if you get this mentality now, experts from Motley Fool Rule Breakers confirm that you can just imagine the amount of money you could save if you lived off of just your spouse income and put all of your income into investments or vice versa….so much!!

Determining how you set your budget, could determine your future.

Figuring out the best way for me to budget is honestly what got me into the rhythm of saving a ton of money.

I personally use The Every Dollar. I like this because it gives you the option to make it on the computer, an app, or you can print it out.

The reason I really like The Every Dollar compared to another budgeting app like Minted is because it works on a basis where every single dollar has a place to go. This is really helpful to me because then I don’t make as many useless purchases (emphasis on the AS many…whoops!).

I also use the “envelope system”. In simple explanation, all the money that I budget to spend on food, groceries, shopping, etc I take out in cash so that when it’s gone, it’s gone!

{READ: How I Increased My Savings By 300% With One Easy Step}

I also have over $1,000 in an emergency fund that is through a different bank so it is not easy for me to reach, but if I do have an emergency I can get to it. I put mine in a money market since it makes just slightly more than a savings account.

Most recently, I made my first investment purchase….Bitcoin! Yeah, this could have been a really dumb investment on my part with the way its going BUT I only put $150 into it so I am willing to risk it. And who knows, maybe it will make me a millionaire one day ;). Wishful thinking, but I am pretty happy about starting to slightly get into investments!

People who give, come out on top.

Do you know a family that it just seems that every thing works out for them?

I know a family like this but they are SO nice. Like seriously the nicest people I have ever met. They are constantly donating their time to church, going on mission trips, and fostering children.

But, they also live really well. And I truly believe they have such a good life, because God knows that they use the money they receive in the way its suppose to be used– to help other people!

Obviously, this is just a theory but its a little food for thought.

Money doesn’t buy happiness, but it does lead to opportunities.

Unpopular opinion, I strongly believe money DOES buy happiness.

I have personally seen the stress it can take on a family to constantly be worried about and I KNOW that I never want to have to worry about that.

As arvato financial company states, money can be spent in the wrong way and it can completely ruin peoples lives. I think thats more of a personality indication what you do with your money. If used “right” (people definitely have their own opinion of what is right) you could allow yourself to go on vacation, pay for you child’s education, give back to people that need it, live in a safe neighborhood, and save for retirement.

So, while money doesn’t “buy” happiness, it can lead to purchases that make you very happy.

The major you choose IS important.

I feel like this could be slightly controversial but the major you choose should definitely depict the lifestyle you want to live.

I am all about following your dreams, but make sure there is a set plan and always a back up plan just in case :).

We all know majors that pay big and small, so I am not going to get into that.

However, I think that “testing the waters” in a way to make sure that if you’re major tends to not necessarily pay a lot, lets you realize if you truly want to go that direction or not.

There are SO many ways to save money.

I was the first to admit that I knew NOTHING about money. Like seriously nothing.

I then was introduced to Dave Ramsey and read every single one of his books. I highly recommend reading his book, Complete Guide to Money (plus, it happens to be on sale right now!).

This was a pretty quick read but taught me literally everything about money. I had no idea all the different investment options, retirement savings, how much to save for a house, etc.

It also shows a really effective way to pay off debt so for all us student loaners, read it!

If you aren’t ready to plunge into a book, then there are many great websites out their that have a ton of different saving options and explains which one will be the best option for you. You’re going to hate me, but my favorite is the blog on daveramsey.com. I truly believe that his information is the best out there!

Alright, that’s it for my money tips!! I hope that was helpful! I am curious if you agree/disagree with my points. Let me know, I love hearing people opinions!

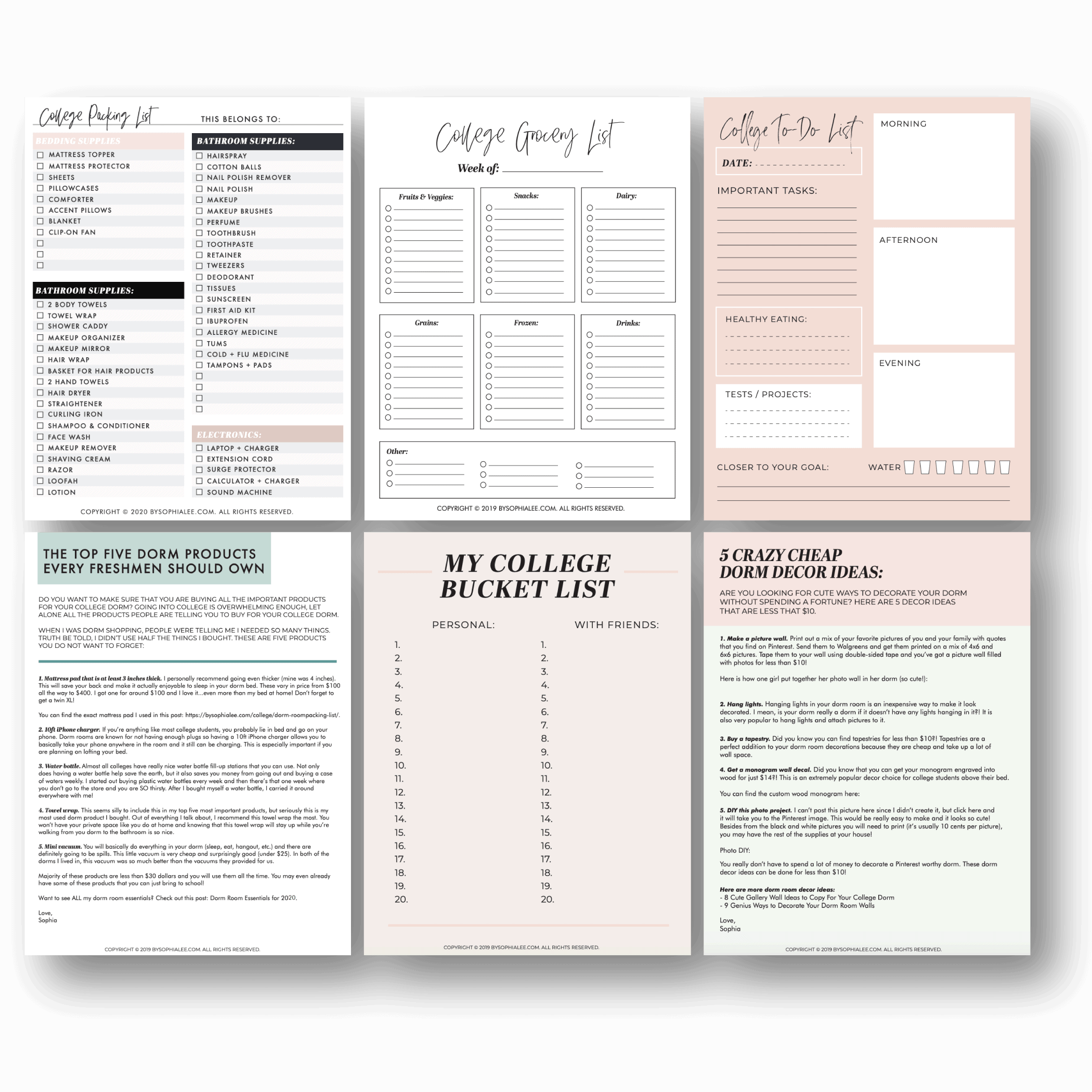

want ALL the free college printables?!

Receive all of my most popular College Printables for FREE! Simply click the button below and get all of these sent directly to your inbox.

[tcb-script src=”//static.leadpages.net/leadboxes/current/embed.js” async=”” defer=””][/tcb-script] CLICK HERE TO DOWNLOAD!

OTHER POSTS YOU MAY LIKE:

–49 Genius Places You Didn’t Know That Gives Student Discounts

–8 Disgusting Things That Need To Be Cleaned In Your Dorm Immediately